Many homeowners discover the hard way that their homeowners insurance policy does not cover property damage from floods or hurricanes. You should consider purchasing flood insurance to protect your home and contents if you live in an area that is susceptible to flooding. This could be anything from a house on the coast that experiences frequent floods to a house that is further downhill from a stream that hasn’t flooded for years. Here are the basics on flood insurance.

What are Hurricanes?

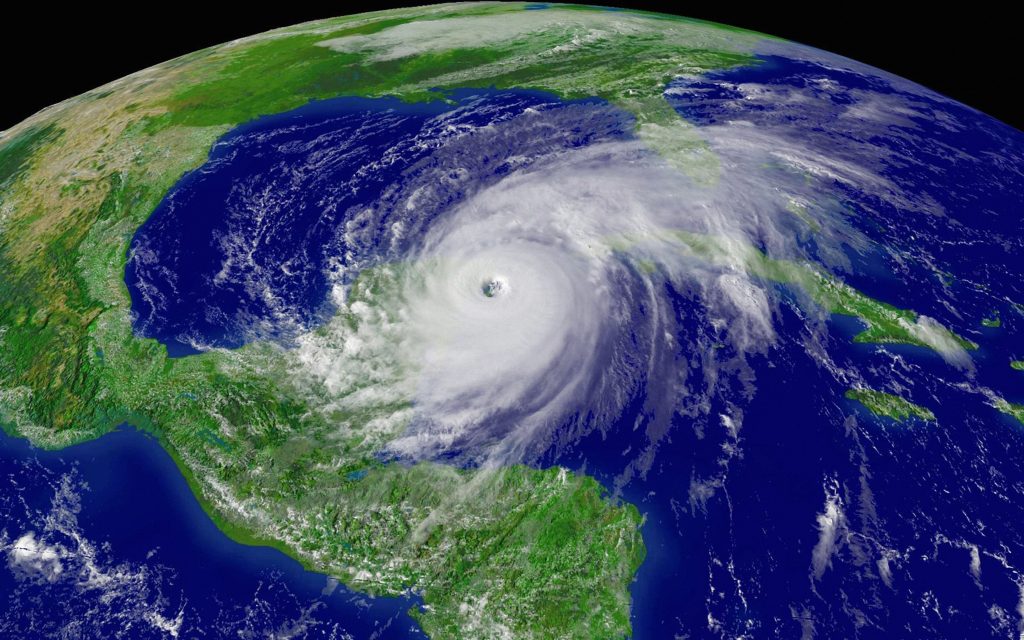

A hurricane is a type of tropical cyclone, or severe tropical storm, that can occur in large bodies of water such as the Pacific Ocean, Atlantic Ocean, and Gulf of Mexico. A tropical depression is a tropical storm that has winds less than 38 mph. Then, it is bumped up to a tropical storm when the winds blow between 39 and 73 mph. It becomes a hurricane when the winds reach 74 mph or higher.

Which States in the US are Hit by Hurricanes the Most?

- Florida

- Texas

- Louisiana

- North Carolina

- South Carolina

- Alabama

- Georgia

- Mississippi

Where Can I Get Flood Insurance?

Flood insurance can be purchased through different types of real estate agents or an insurance broker in the National Flood Insurance Program, which is administered by the Federal Emergency Management Agency. Flood insurance is available to any homeowner who lives in a community that participates in the National Flood Insurance Program. These areas have agreed to pass laws that enforce storm water management.

Flood Insurance Can Cover Your Property & Contents Inside Your Property

Flood insurance policies can offer maximum coverage for property and contents anywhere from $100,000 to $250,000. However, property and contents coverage must be purchased separately. Flood insurance is not necessary if you live in an area that has been classified as moderate- or lower-risk. However, your lender may still recommend that you purchase flood insurance if you have your own observations that show that your local designations are outdated.

For the contents of your home, flood insurance covers the actual cash value. It simply covers the cost of replacing the property that has been damaged or lost based on the actual, depreciated price as used goods.

For your property, if you are insuring a single family home, you can choose replacement cost coverage. This covers the cost of replacing damaged or lost property with new property without regard to depreciation.

What Does Flood Insurance Not Cover?

Flood insurance does not cover all situations. You should be aware of the following restrictions and limitations that flood insurance has.

Water Leaks From Inside the Home

Flood insurance won’t cover you if something happens inside your home, such as frozen pipes bursting. These types of losses should be covered by your homeowners insurance policy.

Swimming Pool Damage

Flood insurance policies won’t cover you if a swimming pool is damaged or destroyed on your property. Flood damage to your property’s flower beds, vegetable gardens, trees or other landscaping is also not covered by flood insurance.

Living Expenses

Flood insurance policies won’t cover living expenses such as renting a hotel room while your property is being repaired from flood damage.

Important Documents

Your policy will not pay for any money, precious metals, certificates that are damaged by floodwaters.

Basement Contents & Basement Damage

Flood insurance doesn’t cover basement repairs from flooding like replacement of the floors or walls. Personal property, including clothing, computers, electronic equipment and kitchen supplies, that is located below the lowest level of your home’s floor, are not covered.

Conclusion

Flood insurance coverage does not kick in immediately, unlike other types of insurance. The longer you wait to look for flood insurance coverage for your home the higher your chance of losing it. Contact your local insurance broker today to discuss flood insurance for your home if you live in an area at risk of flooding from hurricanes.